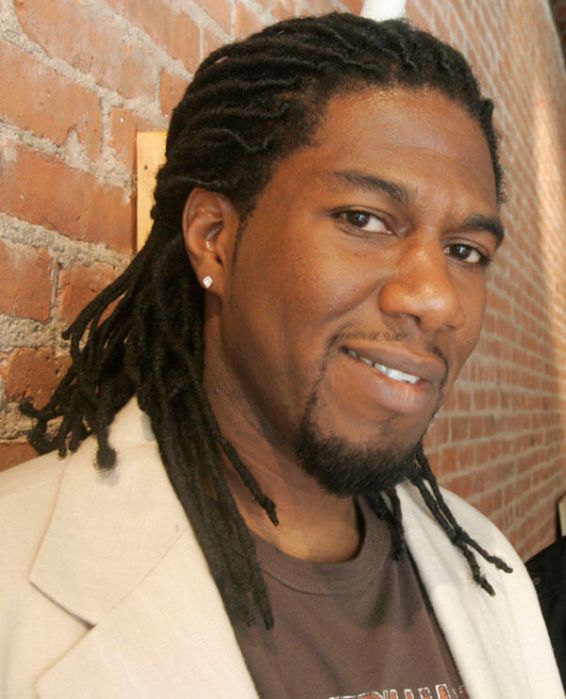

Brooklyn Council Member Jumaane D. Williams, deputy leader of the City Council, has introduced the Credit Nondiscrimination Act, which would outlaw the practice of creditors discriminating in the issuance of credit on the basis of race, gender, sexual orientation, or any of the protected classes.

“This bill can help hundreds of thousands of people applying for mortgages, small business loans, and other types of credit,” said Williams, who represents the 45th Council District in Brooklyn. “Having in place a law that mandates how a person’s interest rate is calculated will protect groups of people in this City that face discrimination and unfair treatment at higher rates than other groups.”

Williams said Intro. 1306 expands on federal and state legislation by amending the City’s Human Rights Law to prohibit discrimination based on an individual’s membership in a protected class in the issuance of credit.

The ACT would require the New York City Commission on Human Rights to conduct outreach, and to perform a credit discrimination investigation for a period of one year.

Creditors would also have to disclose to applicants, regardless of their background, how their interest rate is calculated, Williams said.

He said this builds on existing law that already requires a disclosure of why an acceptance or denial of credit is given.

“New Economy Project applauds Council Member Williams for shining a light on credit discrimination,” said Andy Morrison, New Economy Project’s campaigns coordinator. “Lending discrimination is a persistent abomination that denies New Yorkers economic opportunities and serves to perpetuate racial inequality and segregation in our city.”

Williams said the bill was inspired by a $24 million settlement that alleged Honda creditors “charged higher interest rates to thousands of black, Hispanic, Asian and Pacific Islander customers than white car buyers.”