It is becoming increasingly clear that Trinidad will likely miss the Sept. 30 deadline to sign an agreement with the U.S. to supply commercial banking and other financial information on Americans who stash cash and hide assets overseas.

The island’s parliament was due to debate and approve the Foreign Account Tax Compliance (FACTA) this week but major political differences with the main opposition United National Congress (UNC) have put paid to plans by authorities to get this burden out of the way.

Trinidad and Guyana are among a small band of Caribbean single trading bloc nations which are yet to sign bilateral compliance agreements with the U.S.

The punitive bill was approved by the U.S. Congress back in 2010 to track and trap American citizens and residents who have more than $50,000 stashed in foreign accounts or have assets they care not to let the IRS know about.

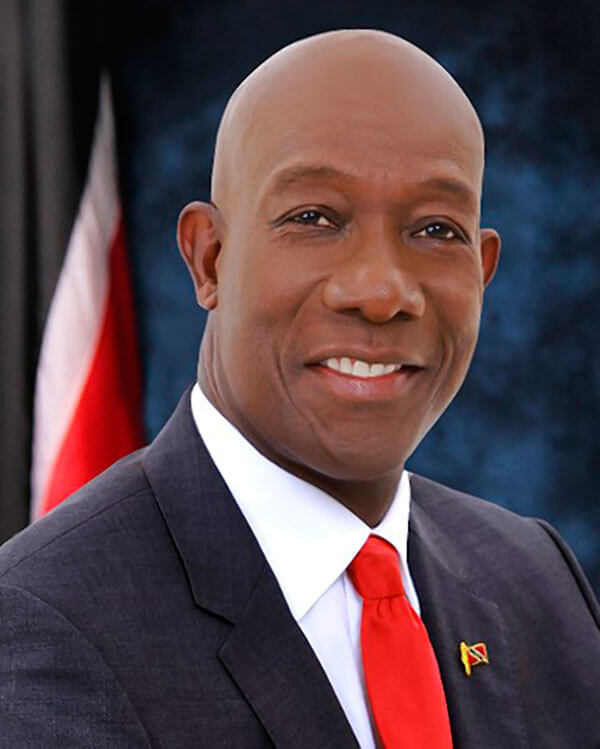

The row in Port of Spain now means that time may be running out for the administration of Prime Minister Keith Rowley as it is clear that cabinet will be forced to ask Washington for an extension beyond the Sept. 30 deadline to comply.

Talks between government and the opposition on what the bill should contain failed this week and authorities bowed to UNC demands to send the bill to a select committee to pore over clauses line by line to determine what will be acceptable to both sides.

The UNC thinks that parts of the document gives too much power to people like Finance Minister Colm Imbert to order the release of personal financial information to the IRS and other federal officials, calling some clauses as breaches of the local constitution. This is despite the fact that the bill is largely the same one that was inherited from the UNC before it lost general elections a year ago this month.

“Put country first today. This isn’t a time for politicizing,” Imbert said during a sitting of parliament. “All banks would lose the corresponding relations they have in the U.S. if this legislation isn’t passed. We have to co-operate or T&T’s banking systems will crash and the economy will crash,” he added.

The bill needs a three-fifths vote or 26 of the 41 seats to be approved. Government is three short of this figure.

Commercial banks on the island and in the Caribbean in general had recently welcomed moves to comply with the legislation and American banks were already threatening to cut off relations with them because of demands for increased scrutiny by federal agencies. They claimed that this increased operational costs.

Asked to chip in on the matter, United States Ambassador John Estrada told local station TV-6 that he was amazed that the island is now in this position at this late hour.

“This is something that was agreed upon, I guess with the last government. I think it was here for a couple years and it was agreed upon with this government. So I am having a hard time understanding why there is a problem but I will have more to say on this a little later. I have to digest what has been happening over the past couple of days,” he said.

The bipartisan committee will begin sitting shortly but all indications are that the month end deadline is in doubt.

“We have decided to facilitate the opposition with a proper joint select committee. Not a rush job and not a piecemeal job and we are reasonably confident that once we provide this information to the U.S. authorities that we shroud be able to get a small extension of time to allow the joint select committee process to be completed properly,” Minister Imbert said.