Pressure of developed countries on other states to tighten their financial laws and regulations to fight money-laundering is yielding unintended victims, such as charities and legal gambling outfits in Barbados that are now crying foul.

Insistence on stringent financial regulations imposed by the Financial Action Task Force of the G-8 group of industrialized nations and regulated through its regional offspring, Caribbean Financial Action Task Force, has seen many international banks dropping correspondent banking services to regional countries in what is termed ‘de-risking’ because of fears of huge financial penalties from United States authorities if they are found doing business with suspected money laundering entities in the Caribbean.

But local institutions are also acting in fear of sanctions on their international trade by upping their verification requirements of Caribbean citizens and businesses with already active accounts and those seeking to register new banking arrangements.

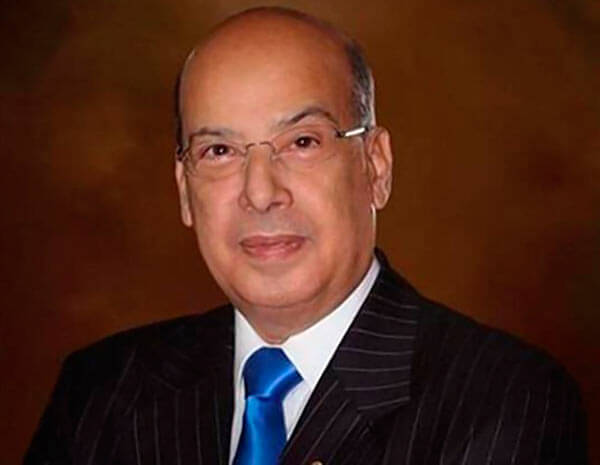

This prompted a frustrated Barbados Member of Parliament and patron of a local charitable foundation, Edmund Hinkson, to complain over the weekend.

“A lot of financial demands and paperwork are being placed on non-profit companies,” he said, adding, “some of the restrictions are too tight.”

Hinkson a veteran lawyer who deals with corporate and criminal matters said that some of the demands for financial information are, “imposed by entities outside of Barbados in terms of money laundering.”

His issue is that these impositions are for personal information of would-be local and international donors to his and other charities. Additionally, the very searching requests on personal finances make many persons shrink from appointments to boards of charitable organizations.

“Largely these are non-profit companies that are trying to advance the cause of [needy people],” Hinkson said in pointing to the organizations that suffer because of the regulations.

“We have too many restrictions in terms of establishment and the future progress of foundations and non-profit companies.”

Two days following Hinkson’s cry, Attorney General Adriel Brathwaite spoke of slot machine business operators who have been offering legal gambling on the island for 25 to 30 years now having their bank accounts closed.

“These are legitimate businesses but someone sits outside the region and makes a decision that ‘this is gambling therefore we are not touching it.’”

The unwillingness of international financial houses to recognize the licensed gambling operations in Barbados has apparently scared off the island’s five retail banks, three of which are headquartered in a G-8 country.

The attorney general spoke of receiving a Whatsapp message from a slot machine operator with a photo of a large amount of cash on a table and a note from the business owner pleading: “AG help me we don’t know what to do with this. Our bank account has been deactivated and we are paying our staff with cash.”

Brathwaite said other businesses that suffered the same fate with the banks have resorted to storing their money in suitcases.

The collateral damage from international banks de-risking and the almost obsessive reactions of local financial houses in the Caribbean threaten to take the region to a place it has never been before.