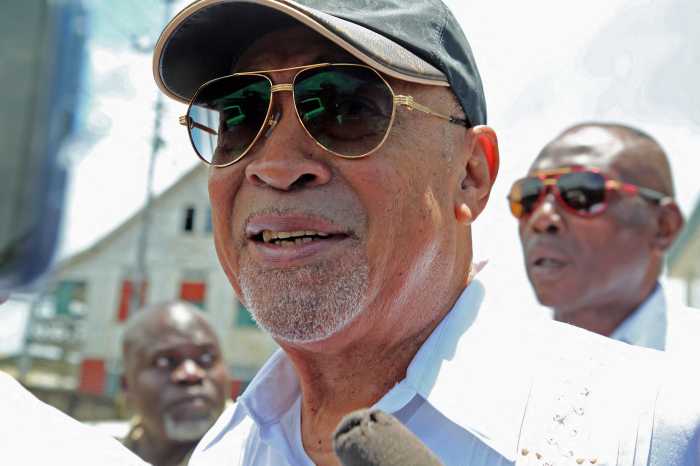

When voters booted out the elected, civilian administration of former military strongman Desi Bouterse in mid-2020, Suriname’s foreign exchange rate was a mere US$8-1 Surinamese dollar (SRD), but today there is a frenzied effort to prevent the local currency from a free fall that could further fuel inflation.

Under severe pressure from consumers, opposition parties and from within his own multiparty coalition itself, President Chan Santokhi said tough new measures will have to be implemented to stabilize the local currency as citizens are under severe pressure.

Late last year, the central bank allowed the currency to float, ending a long period of fixed rate policies. The new measures to float the dollar were forced on authorities by the International Monetary Fund (IMF) in exchange for a $690 million loan to be repaid over three years. The IMF imposed the mandate on the Dutch-speaking Caribbean Community nation largely because it had oftentimes defaulted on its debt loan payments.

Today, the exchange rate has declined to almost $30-1 and is steadily weakening. Speaking to the nation of just over 500,000 on Thursday night, Santokhi blamed an exponential increase in demand for the American dollar in recent months, noting oil imports have become way more expensive than two years ago, prices for consumer items and durables have also pumped up exponentially. He said the basic difference between demand two years ago and today for the currency is easily around $100 million.

He said he plans to appoint two working groups to look at measures to reduce the price of imports which are passed on to hapless consumers. One, comprising government and private sector officials will focus on ways to access cheaper imports. The other will examine measures to stabilize prices.

Central bank figures indicate that consumer prices have risen by 49 percent compared to a year ago, while housing maintenance, home repairs and utility prices have jumped up by 225 percent . The statistics bureau also released recent figures showing that transport costs have risen by nearly 74 percent, while food products like fish and shrimp have moved up by 58 percent.

Acting Minister of Finance, Silvano Tjong-Ahin said this week that the country is in the grip of tough IMF policies aimed at repairing a damaged economy. “This will be a way of life for a while yet,” he said.

“We are still in an adjustment program. We’re not going to get out of it. We are still an import country. W need to move to an export country. This has been called for by various governments for years, but there is hardly any talk of further developing the industrial sector. We look at the actual development of the exchange rate on the basis of the calculations of the central bank. This is not the course we would like. But we have to get used to a situation of a free market price. We have to look at the whole. The bank consumes the weighted average of all prices,” the Herald newspaper quoted him as saying.

The economic problems authorities are facing there appears to have created a slight opening for opposition parties as they are moving to capitalize on the discontent brought on by the struggle to make ends meet on a daily basis.