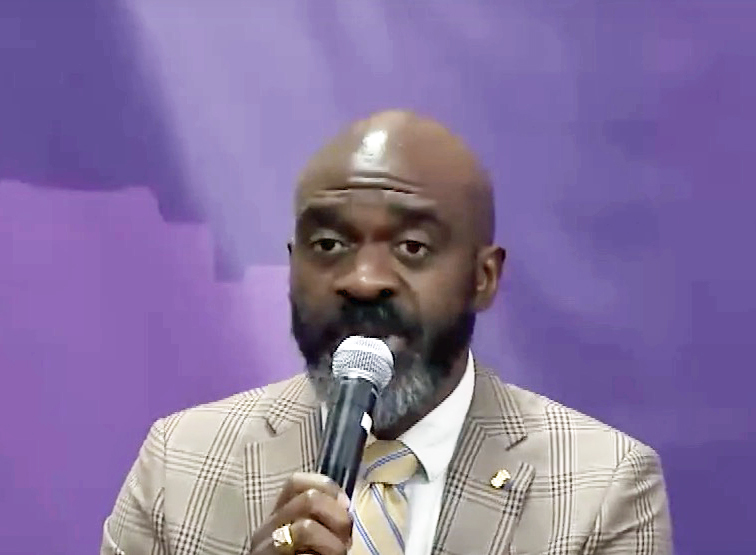

As the US House of Representatives and the Senates voted along party lines to pass what has been described as the most sweeping rewrite of the American tax code in decades, Brooklyn Democratic Congresswoman Yvette D. Clarke has strongly condemned the Republican-led measure.

“Policy reflects priorities and the GOP’s [Grand Old Party] priorities are clear: billionaires first, everybody else second,” said Clarke, the daughter of Jamaican immigrants, Tuesday in voting against the bill.

“Eighty-six percent of middle class families will pay more in taxes,’ added the representative for the 9th Congressional District in Brooklyn. “Americans will face higher healthcare premiums, and 13 million people will lose their coverage altogether.

“Twenty-five billion dollars will be cut from Medicare,” she continued. “The bill slashes the highly popular state and local tax (SALT) deductions and increases the debt by as much as $2.2 trillion, leaving our children and grandchildren to deal with crushing debt. What’s worse, good paying jobs will be shipped overseas.”

Clarke also said the bill “supports Republicans’ trickle-down delusions, not analysis or facts. It was written first and foremost for the wealthiest one percent, lobbyists and donors, not ordinary Americans.

“Every Republican who voted for this legislation will be forced to answer why they chose the donor class over the working class,” she said. “They’ll have to explain why they’ve made corporate tax cuts permanent, while making tax cuts for hard-working American families temporary. “The American people will continue to make their voices heard and hold Republicans accountable for this tax scam. Republicans own this.”

On Tuesday and into the wee hours Wednesday, the Republicans moved towards notching their first significant legislative victory since assuming full political control of the House and Senate.

The $1.5 trillion tax bill, which is expected to head to President Trump’s desk in the coming days, will have broad effects on the economy, making deep and lasting cuts to corporate taxes, as well as temporarily lowering individual taxes, according to the New York Times.

It said the initiative was not without hiccups, however, as three small provisions in the final tax bill agreed to by the House and Senate were found by the Senate parliamentarian to violate the budget rules that Republicans must follow to pass their bill through a process that shields it from a Democratic filibuster.

As a result, the bill changed slightly in the Senate, and the House will now need to vote on it again since both chambers must approve identical legislation. Among the items that were deemed out of order was the title of the bill: The Tax Cuts and Jobs Act, the Times said.

It said approval of the bill in the House and Senate came over the strenuous objections of Democrats, who have accused Republicans of giving a gift to corporations and the wealthy and driving up the federal debt in the process.

As the final vote approached in the Senate, Chuck Schumer of New York, the Democratic leader, gave his closing argument against the bill and scolded his Republican colleagues for talking during his remarks on the floor.

“This is serious stuff,” Schumer said. “We believe you’re messing up America. You could pay attention for a couple of minutes.”

Representative Nancy Pelosi of California, the House Democratic leader, called the tax bill a scam, saying it “is simply theft — monumental, brazen theft from the American middle class and from every person who aspires to reach it.”

On Tuesday afternoon, the House voted 227 to 203 to pass the bill, with 12 Republicans voting against it and no Democrats voting for it, according to the Times.

It said 11 of the 12 Republicans were from California, New Jersey and New York, states that would be hit hard by a provision in the bill limiting the deduction for state and local taxes to just $10,000. The Senate approved the bill early Wednesday morning.

The Senate voted 51 to 48, with no Republican defections and no Democratic support, the Times said.

It said that, under the final tax bill, the corporate tax rate would fall to 21 percent, from the current 35 percent, “a move that Republicans are betting will increase economic growth, create jobs and raise wages.”

Individuals would also see tax cuts, including a top rate of 37 percent, down from 39.6 percent, the Times said.

It said the size of inheritances shielded from estate taxation would double, to $22 million for married couples, and owners of pass-through businesses, whose profits are taxed through the individual code, would be able to deduct 20 percent of their business income.

But the individual tax cuts would expire after 2025, a step that Republicans took to comply with budget rules, which do not allow the package to add to the deficit after a decade, the Times said.

It said the tax changes will affect businesses and individuals unevenly, with winners and losers often being determined by industry or geography.

An analysis by the Tax Policy Center found that the bill would reduce taxes, on average, by about $1,600 in 2018, increasing after-tax incomes 2.2 percent, with the largest benefit going to the wealthiest households, according to the Times.

It said the reach of the bill extends beyond taxes, striking at a core component of the Affordable Care Act [Obamacare], eliminating the requirement that most people have health coverage or pay a penalty, a move that the Congressional Budget Office projects will increase premiums for people who buy insurance.

The bill would also open the Arctic National Wildlife Refuge in Alaska to oil and gas drilling, a defeat for environmentalists who have fought against such action for decades, the Times said.

It said the last-minute parliamentary stumble involved three small components of the bill, according to Senate Democrats, including a provision that would have allowed the use of 529 savings accounts for homeschooling expenses and part of the criteria to be used to determine whether colleges and universities are subject to an excise tax imposed on their investment income.

The parliamentarian even ruled against the bill’s name, the Tax Cuts and Jobs Act, since the provision creating the name did not influence spending or revenue, as each provision must under Senate budget rules, the Times said.

It said critics of the tax bill have argued that it will enrich a number of Republican lawmakers who supported it. They pointed specifically to Senator Bob Corker of Tennessee and Trump himself, who both hold real estate investments that will get favorable tax treatment through the legislation.

But while the mood among Republicans at the Capitol was largely triumphant, Democrats were already looking ahead with a focus on next year’s midterm elections, when they hope to wrest control of the House and Senate, according to the Times.

It pointed to polls that have shown that the Republican tax overhaul is unpopular with the public.

Democrats hope to turn the biggest Republican legislative achievement into a liability in next year’s races, the Times said, with Schumer warning that Republicans would come to regret rushing the tax bill through Congress on their own.

“This tax bill will be an anchor around the ankles of every Republican,” Schumer warned.

Protesters also made themselves heard as both chambers voted. As senators cast their final votes on the bill, protesters rose in the gallery of the chamber and began chanting, “Kill the bill, don’t kill us,” the Times said.