In the wake of concerns by tourism officials about the impact from higher travel taxes and duties imposed on overseas source markets, two Caribbean islands are introducing new travel taxes.

The Jamaican government said that an agreement was recently reached between the Jamaica Hotel and Tourist Association (JHTA) and the government on tax measures to be imposed on the tourism sector under the 2012-2013 budget.

The agreement will see the introduction of a US$20 fee for each arriving passengers, whose trip originates abroad, as of Aug. 1. Effective Sept. 1, an accommodation tax will be introduced for each occupied room per night of US$1 for properties with less than 51 rooms, US$2 for hotel with 51-100 rooms and US$4 for hotels with l01 rooms and above.

The news comes on the heels of an announcement a week earlier that the Antigua and Barbuda government had presented and passed the Airport Administration Charge Act, 2012, which now takes the Antigua’s overall airport taxes to US$93.75 up from US$63.75 and will be built into the cost of travelers’ tickets.

The move was strongly condemned in March by the International Air Transport Association (IATA), which reportedly wrote a strongly worded letter to Civil Aviation and Culture Minister John Maginley stating that the new taxes would stand at a level that far exceeded the regional average and stood well beyond a viable level of airlines.

However, the Antigua and Barbuda government remained undeterred and following the June 6 passage of the act, it has mounted strong defense of the move.

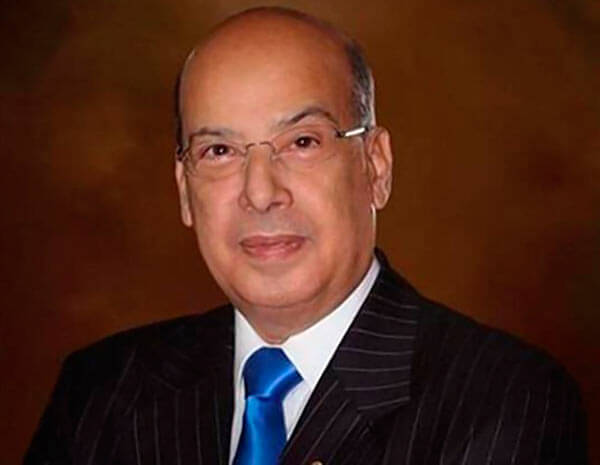

Prime Minister Baldwin Spencer described the new tax measure as reasonable and fair while brushing aside suggestions that the move would bring irrevocable harm to the country’s tourism industry.

The prime minister said the airport needed to be in a position where it would effectively pay for itself in the long term and the improvements to the airport terminal came at a price.

Similarly, Jamaica’s Minister of Tourism and Entertainment, Dr. Wykeham McNeil staunchly defended his government’s new tax measure.