Until regional finance ministers and Caribbean Community heads like Gaston Browne of Antigua and Perry Christie of the Bahamas made some noise about it, the problems some commercial banks have been experiencing with counterparts such as Bank of America in recent months were hardly known to people in the region.

As the two leaders put it, the region is now being unjustifiably labeled as a high risk area and those in authority outside the region are discouraging international financial institutions from completing transactions made in the Caribbean trade bloc.

The issue was discussed extensively at last week’s two-day summit which ended in the Bahamas at the weekend.

The result of the discussions by leaders and finance ministers is that governments have agreed to establish a special committee of finance ministers to probe reasons why American and European commercial banks are reluctant to transact business with regional counterparts saying they fear many will soon face closure if the situation is not corrected.

CARICOM Chairman and Bahamian Prime Minister Christie announced the setting up of the ministerial sub-committee to try to determine why “the region is being unjustly labeled as a high-risk area for financial services.”

The ministers are scheduled to hold talks with the umbrella Caribbean Association of Indigenous Banks on the issue in the coming weeks as the situation is considered as serious and urgent Christie said.

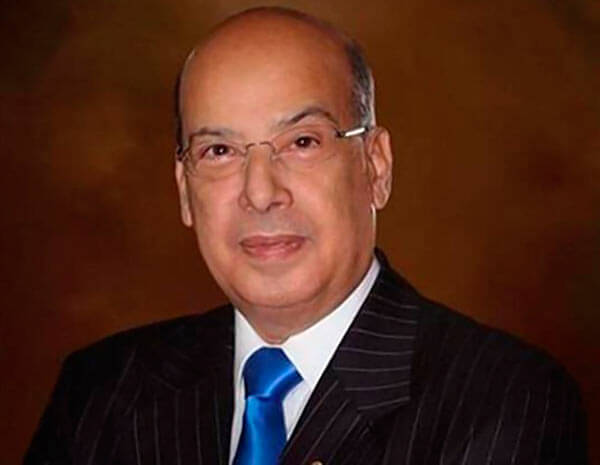

Immediate past group chairman and Antiguan Prime Minister Browne raised the issue during the summit saying that many banks in the Caribbean face imminent closure and this has nothing to do with their financial health or operational wrongdoing but simply because American correspondent banks are refusing to collaborate with the region because it has unjustifiably been labeled as a high risk area. Where the labeling has come from is anybody’s guess he said.

Indigenous member banks have at least $30B in assets Brown said so money certainly cannot be an issue in this regard he argued. He pointed out that the region is at a loss to find out why it has been labeled as high risk.

“Unless this situation is addressed with urgency, the indigenous banks in each of our countries will be forced to close their doors, not because of any inherent difficulties in the banks themselves, but because they are constrained from transacting business abroad.”

Browne said that the region is wasting no time in trying to solve the misconception that the area is bad for business, noting that “if banks are unable to settle their transactions in the United States, Canada and Britain, that clearly has serious implications. It means therefore that we wouldn’t be able to settle our trade transactions expeditiously. It also has implications for investments and we thought that rather than having the banks deal with these issues on their own, that there was need to elevate it to the level of the regional governance and to have CARICOM as a whole address the issue with various entities, to include the IMF, the World Bank, OAS and also to have dialogue with the correspondent banks in the various countries.”