Having found itself among four Caribbean countries in a newly-released European Union blacklist of offshore territories, Barbados is calling on the 15-member CARICOM grouping to lead a charge against these smears that are periodically put on regional states.

European Union finance ministers stated on Dec. 5 that the union had placed Barbados, Grenada, St. Lucia, and Trinidad and Tobago among 17 countries on a tax havens blacklist for failing to meet agreed tax good governance standards.

But this is not all, as the European Union explained that its concerns about Caribbean countries failing to meet its set standards could include many more but listing of them will be delayed as they are given time to recover from natural disruptions this year.

“For certain jurisdictions, specific factors needed to be taken into account. For example, eight jurisdictions, Antigua and Barbuda, Anguilla, Bahamas, British Virgin Islands, Dominica, St. Kitts and Nevis, Turks and Caicos, United States Virgin Islands, that were badly hit by the hurricanes in summer 2017 have been given until early 2018 to respond to the European Union’s concerns,” the statement read in part.

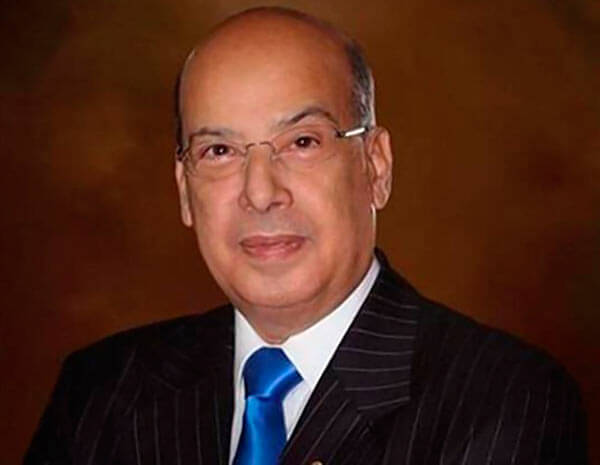

This triggered Barbados Minister of International Development, Donville Inniss, to issue a call for CARICOM to rally together as a bloc and jointly present the case in defence of member states’ financial centres.

“Being mindful that our region will continue to be under scrutiny and attacks from other regional groupings and multinational organisations, Barbados will once again request a regional dialogue on the matter with the goal of establishing a high level regional team of experts to engage with external parties on behalf of the region,” Inniss said Wednesday, and added, “we really expect that CARICOM will take the lead on this matter.”

As regards Barbados being named in the blacklist, Inniss said it is a surprise because in the past months he and island officials had been in direct talks with the relevant European Union authorities including the Forum on Harmful Tax Practices.

“It is the view of the Barbados government that to include Barbados in Annex 1, listed as a non-cooperative tax jurisdiction, is extremely unfortunate and unfair in light of, and despite Barbados’ recent direct engagement with the European Union Code of Conduct Group over the past months,” Inniss said.

“I wish to state forcefully that Barbados is not a non-cooperative jurisdiction in taxation matters or any other matter. We are and remain cooperative, but true to our ideals and policies as a sovereign nation as we strive to be the international financial jurisdiction of choice,” he added.

In spite of his call for a coordinated CARICOM-strong approach to this European Union aggressive action and other attacks on territorial financial centres that that account for much revenue of these states, Inniss said Barbados will act while hoping for joint Caribbean action.

“Barbados has therefore enquired of the European Union yesterday morning by way of email as to which regime Barbados has not clearly committed to amending,” he said, adding, “with respect to the way forward, Barbados will dispatch a detailed correspondence to the European Union requesting an urgent review of their rather unfortunate listing.”