A philanthropic group, the Aaron and Cristina Foundation, has become the latest organization to complain about the impact of a new Barbados import tax, which an official said is affecting the quality of its donations.

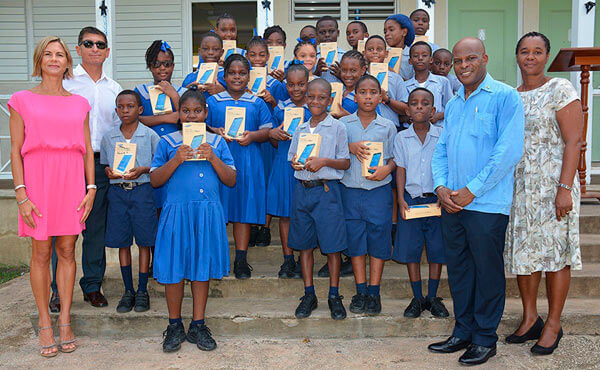

The foundation, which has a stated objective of promoting and facilitating children’s education at the primary and secondary levels in Barbados, has for years been presenting electronic tablets to children who are beginning secondary school across the island, but founder member Aron Truss recently bemoaned the effect that the National Social Responsibility Levy has had on the gadgets.

“It is very unfortunate that tax was levied on tablets. That has cost us 10 percent more this year than it should have and I really feel that charities and tablets should be exempted from the tax,” he said.

Introduced at two percent in 2016 as a levy on imports to raise funds for health services, the NSRL was jacked up to 10 percent as of July 01, this year. With the exemptions only for select food items and operators in certain industries such as tourism, the tax affects every item on the island that is more than 70 percent dependent on imports of goods and inputs for services.

Prior to July this year, computers and related electronic items were tax free as they had been regarded as essential to keeping Barbadians on the information highway and on par with state-of the-art technology.

But such items are now caught up in the jacked NSRL 2017 net.

Faced with a 10 percent increase in the cost of these items destined for a charitable cause, Aron Truss said that the foundation had to scale down in types of these educational gadgets bought.

He said that up to 2016 students were being presented with Samsung Galaxy tablets as aids in their schoolwork but as of the beginning of this school year in September his group was giving them Amazon Kindle Fire gadgets.

That foundation’s cry last weekend was matched by the Barbados Chamber of Commerce and Industry that has warned of likely job cuts in January stemming from the impact of NSRL.

According to a report in the Nation newspapers, Abed explained, “at the end of the day, no one likes to make tough decisions when it comes to staffing. These are friends, citizens, neighbours and people you interact with on a daily basis. This is not an easy decision for any employer to make,” BCCI president Eddie Abed said.

“If you think business is going to get better in the short term, you will do what is necessary to hold on. If you feel that in the short term it will get no better, you’re going to make a decision that protects the business.”

Abed spoke of a reduction in growth of the economy from 2.2 percent up to June to 1.4 percent by September, coinciding with imposition of the 400 percent hike in the tax.

“We have seen a reduction in growth in three months primarily due to the slowdown in business as a direct result of the imposition of the NSRL,” he said, adding, “as prices have gone up, the volumes at which businesses can sell currently, as opposed to before, has slowed significantly. Frankly, with inventory sitting on the floors of many of our businesses in this country, they then need to look at how best they can cut their expenses, which is labour.”

He said cuts are not expected immediately, “but I think that any business, unless they have a good Christmas, will be forced to make that decision come January”.