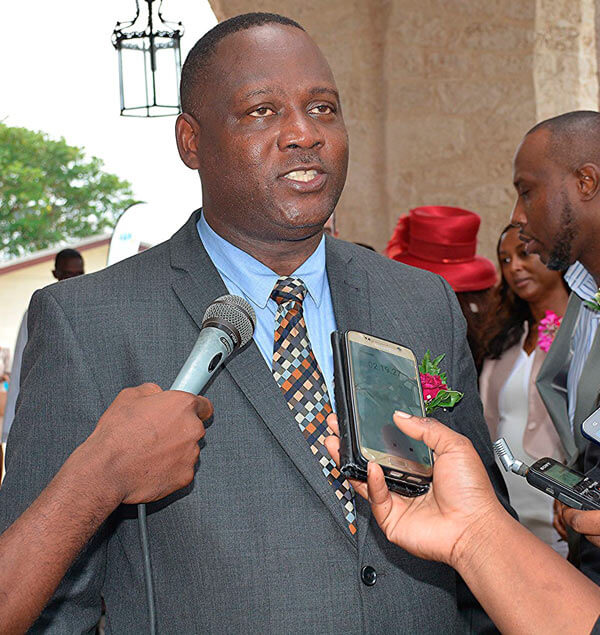

The appearance of the island’s name among 19 ‘secrecy’ territories holding accounts of the rich and famous in the so-called Paradise Papers has Barbados Government Minister Donville Inniss hopping mad.

“There is a group of individuals and companies around the world that seems to exist solely to spread a lot of rumours and cause a lot of confusion around the world,” Inniss said to members of the media Tuesday when asked about the papers leaked from the international law firm and corporate services provider, Appleby. that purports to reveal investment and money-saving practices by persons who that take advantage of loop holes in their native countries to lodge their money elsewhere and avoid taxes.

Barbados is listed among 12 Caribbean states that fall into a group of 19 countries worldwide where the rich and famous are said to have placed substantial portions of their wealth.

The names of some 34 companies resident and registered in Barbados have reportedly appeared among the 13.4 million Appleby files obtained and recently released by a German newspaper.

But Inniss’ particular area of objection is Barbados being described as an offshore tax haven where money can be hidden.

“I won’t deny that there are jurisdictions that may facilitate tax evasion as some illicit activity but Barbados, I must stress over and over again, is not that kind of domicile. We have never been a country that could justifiably earn the reputation of being a tax haven. We do charge taxes to businesses in this entity, whether they are domestically, regionally or internationally owned,” he said.

The minister of International Business added, “more importantly, we always strive to improve on the regulation of those entities that come into the space, whether it be domestic, regional or international. One must appreciate, given the dynamics of international business and global finance, the domicile of Barbados will always be picked on.”

Insisting that Barbados is “well regulated and adhere to the highest possible standards,” he said.

“I have had potential investors complain about the difficulty in dealing with some of our systems and I have always contended that if you can legitimately do business in Barbados you can legitimately be doing business anywhere in the world. The minute you want shortcuts take your business elsewhere.”

Inniss dismissed the revelations millions of documents, that have caught many around the world by surprise, as being pushed by those seeking to bring down legitimate businesses in these islands.

“With those Paradise Papers, you will get a lot more of that happening.

“They like to pick on politicians and wealthy individuals in their own countries and seek to trace where they are engaging and investing. But I am satisfied that the majority of investment that such entities and individuals make are done in a very legitimate manner, designed to protect assets,” he said.