Barbados finds itself smack in the middle of Caribbean territories that the Organisation for Economic Cooperation and Development believes could be sheltering Europeans from paying taxes in their homeland.

The OECD’s publication Tuesday of eight Caribbean countries among 20 territories is the latest in a series of shifting goalposts on so-called tax evasion targets set up by that European Union organisation, which in conjunction with the wider developed nations-based Financial Action Tack Force has been accusing small developing states of facilitating tax evasion.

This list, updated on Oct. 17, claims that the named Caribbean countries and other nations are helping EU citizens by giving them passports and other documents of residence showing that these low-tax jurisdictions is their home and they therefore must pay their taxes there instead of to the European country of their birth.

“While residence and citizenship by investment (CBI/RBI) schemes allow individuals to obtain citizenship or residence rights through local investments or against a flat fee for perfectly legitimate reasons, they can also be potentially misused to hide their assets offshore,” the OECD stated.

This basically means that the OECD is objecting to wealthy European citizens pursuing their life’s dream of securing permanent residence in a Caribbean paradise — in some cases — by investing money — commonly referred to as Citizenship by Investment — or simply buying a property in which to live.

“In particular, Identity Cards and other documentation obtained through CBI/RBI schemes can potentially be misused abuse to misrepresent an individual’s jurisdiction(s) of tax residence,” OECD stated.

In the eyes of OECD, Barbados’ offence this time around is in granting ‘Special Entry and Residence Permit’ to wealthy persons who purchase property on the island in pursuit of their wish to live in that major tourist destination.

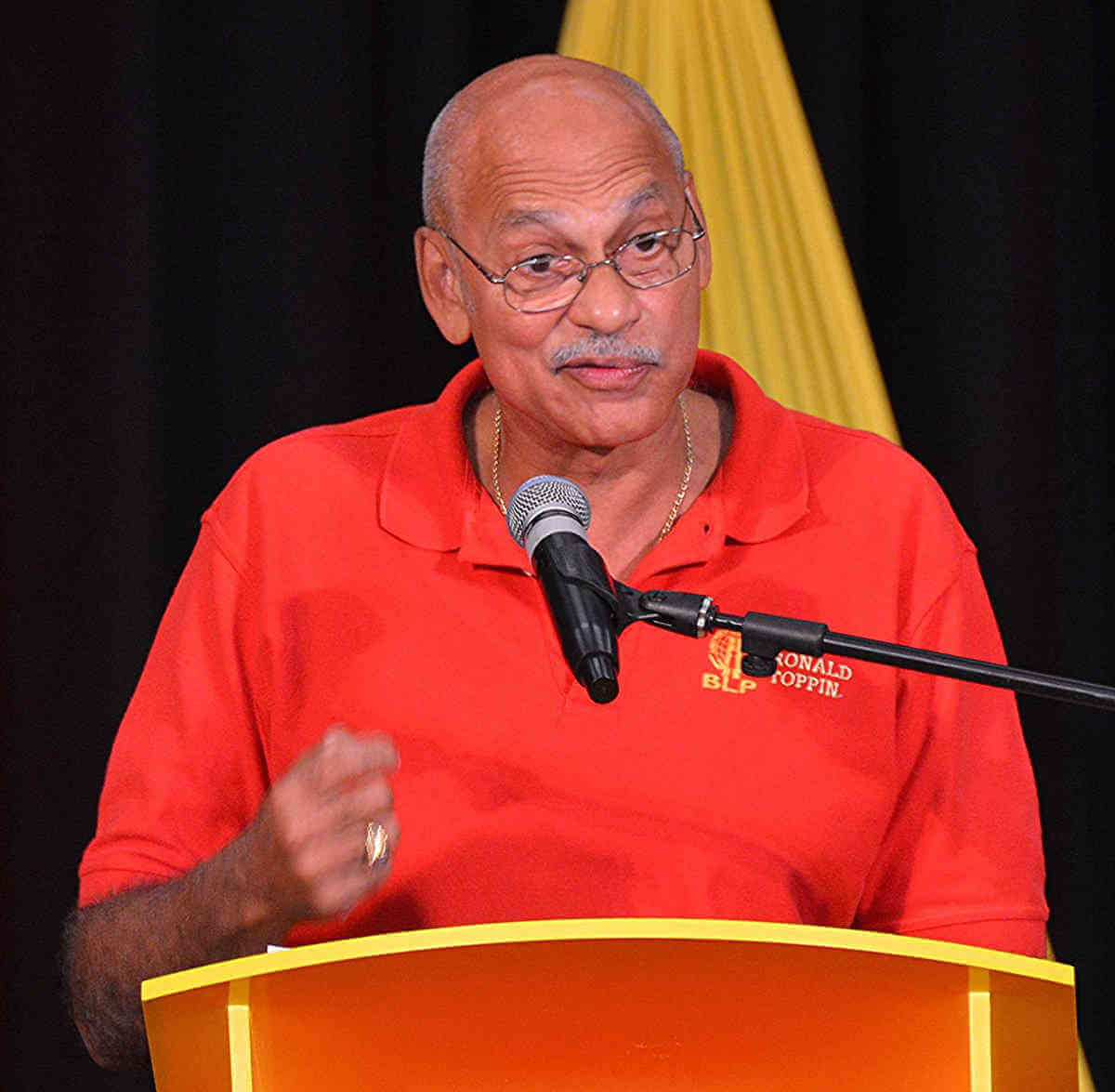

Making clear that the OECD’s statement of its worry about rich people choosing to live there does not mean the island is blacklisted, Government through International Business Minister, Ronald Toppin, stated Wednesday, “Barbados is, therefore, under no obligation to take any measures to change its High Net Worth Individual Special Entry Permit regime”.

Barbadian officials happened to be in Europe in talks with OECD officials when this list was released and immediately clarified that the island was not blacklisted and that the Europeans would say as much in a soon to come statement.

Eight other Caribbean territories, Antigua and Barbuda, Bahamas, Dominica, Grenada, Montserrat, St. Lucia, St. Kitts and Nevis, and Turks and Caicos Islands have either economic residency or citizenship by investment programmes, or both, and it is unclear whether the coming OECD statement will exempt any of them from the dreaded blacklist that scares away other investors.

The issue that small Caribbean states, especially, have with the OECD and FATF dictats is their evolving nature, which demands more adjustment in the already fragile economies of these fragile economies.

An example is a recent European interference in the levy measures of sovereign Caribbean states and others by demanding that these jurisdictions place their taxes on all corporations at the same level.

That dictat, behind which lies the dreaded blacklist for those who disobey, means Caribbean and other governments must converge taxes of international companies and local ones to one rate.

These small territories have been attracting international companies with low corporate taxes but the territories money have been earning through the business those companies conduct internationally and locally.

The dilemma these countries now face is that if they raise the international business tax to that of local companies, the jurisdiction will no longer be attractive to such companies.

On the other hand, if they lower local company taxes to the level of the international businesses, a major source of government revenue would be eroded.

Caribbean states and others are currently in the throes of working out the tax convergence, with officials fully aware that when this is worked out another condition will be set in this game of shifting goalposts.