UBS Bank, USA this week announced the funding of a significant small business loan program through the Tri-State Business Opportunity Fund (TBOF), a lending vehicle for small businesses in the New York Metro region. Located in New York City, TBOF will provide up to $20 million of alternative financing solutions for qualified small business owners in New York, New Jersey and Connecticut seeking loans of $50,000 to $500,000. With the New York Metro area having the largest population of small businesses in the United States, TBOF meets an important need for this market, as such funding is not readily accessible.

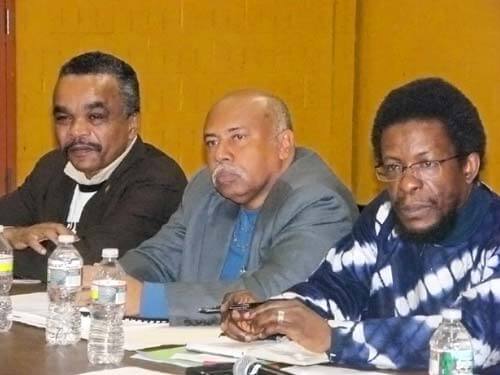

TBOF is a nonprofit lender created by the Valley Economic Development Center (VEDC) in partnership with UBS. VEDC is a transitional small business lender and established Community Development Financial Institution. TBOF demonstrates UBS’s ongoing commitment to provide resources for existing small businesses positioned for growth and is part of UBS’s Elevating Entrepreneurs program. Elevating Entrepreneurs is a joint undertaking of UBS Community Affairs & Corporate Responsibility, Americas and UBS Bank USA.

“We are proud to be expanding Elevating Entrepreneurs to include a new funding source for small businesses in New York, New Jersey and Connecticut,” said Bob McCann, CEO of UBS Group Americas. “By providing growing companies with the capital they need to prosper and create jobs, UBS is not only helping them succeed, we’re helping America succeed.”

“Small businesses are the key to a strong local economy and thriving community, and VEDC has a long history of supporting small business owners,” said Monique Fortenberry, District Director of the United States Small Business Administration.

Roberto Barragan, president and CEO of VEDC, added: “Across the New York Tri-State area, there is an overwhelming need for funding among high-potential small businesses who have a clear vision for growth, but are unable to execute their strategy because of limited access to capital. We are thrilled to launch TBOF to address this critical gap in the market, help entrepreneurs expand their companies, and ultimately create jobs.”

Through a separate $5.5 million multi-year grant, UBS is supporting VEDC’s national expansion efforts. Alongside the $20 million in the New York metro area, a total of $35 million in capital is now available for loans to small businesses in Connecticut, New York, New Jersey, California, Illinois, Nevada and Utah. To date, $6.4 million has been loaned to 28 small businesses, which has resulted in the creation of 453 new jobs.